Investment in Mexico, Mexico with MIST "M" wants to overtake BRIC countries

Investment in Mexico, Mexico with MIST "M" wants to overtake BRIC countries

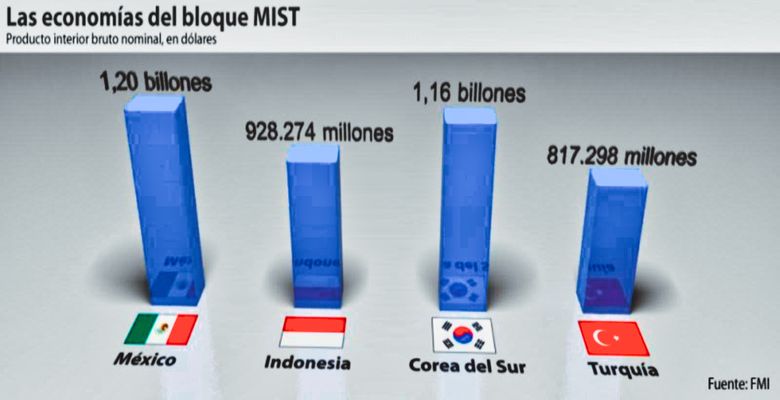

The country, along with Indonesia, South Korea and Turkey, would lead global economic growth in the next decade, but structural reforms are pending for good omens.

Francisco Muciño

In 2001, Jim O 'Neill, an economist at the US bank Goldman Sachs, coined the term BRIC, which encompasses the four emerging economies with more growth potential. This brand became a letter of recommendation to invest in these countries (Brazil, Russia, India and China), which had accelerated growth in the last decade. Investment in Mexico.

But the furor over the BRIC brand is running out. These countries, especially Brazil and China, are slowing down and losing competitiveness with respect to others. That is why Goldman Sachs 'Jim O' Neill has already created another label that includes the new emerging ones that, in his opinion, will be at the forefront of growth in the coming years: MIST (Mexico, Indonesia, South Korea and Turkey).

An analysis by Nomura Securities International names Mexico as "the first jaguar in Latin America". O 'Neill even expects Mexico to be the seventh global economy by 2020. But to do that, investors expect structural reforms to be implemented, delayed for so many years.

Best 'bricks' for the world

"It is time for the world to be built with better 'bricks'," said Jim O' Neill in a Goldman Sachs paper on November 30, 2001. It was the first time the British economist mentioned the term BRIC, Word game with 'brick', brick in English.

Although it was made clear that these countries are very different economically, socially and politically, Goldman Sachs emphasized their economic potential. Even at that time they had conservative forecasts: the bank predicted that within 10 years, China would be as big as Germany (currently the second largest economy in the world) and India and Brazil would be close to Italy (both are already ahead of The European economy).

At the outbreak of the economic crisis of 2008, the importance of emerging economies, particularly the BRICs, became more visible, to the extent that the G7 forums, which brought together the seven most industrialized countries in the world, Fit the emerging ones to transform into what we know today as the G20.

The last decade was fruitful for the BRICs, which with the positioning of this brand enjoyed a wide recommendation for all the investors in the world. In the past 10 years, the accumulated stock yields of these countries far exceeded those of industrialized economies, such as the United States, according to an analysis by the bank Ve por Más.

MIST, the new BRICs?

The global contraction for the 2008 economic crisis would have been even more severe had it not been for the BRICs, which maintained growth during these years, notes the Economic Commission for Latin America and the Caribbean (ECLAC) in a 2009 report. However, after 10 years of success, these economies begin to show signs of fatigue.

From 2010 to 2011, China's GDP growth went from 10.4% to 9.4%; That of India, from 9.5% to 6.8%; Of Brazil, from 7.5 to 4.3%, and that of Russia remained at 4.3% in these years, according to data from the World Bank.

In July, China and India had been in sharp decline, while industrialized countries, after the crisis, would grow moderately, the Organization for Economic Co-operation and Development (OECD) reported. On the Brazilian side, the growth outlook was cut from 4.5% to 2.7%.

This weakening could be explained by the overheating of these economies and because the BRIC model is running out, explains Carlos Ponce, director of Stock Market Analysis and Strategy for Ve por Más.

"The BRICs are a little exhausted. There are different analyzes that tell you about overheating, maybe because too much money came in. It does not mean that they are going to do badly now, but probably the greatest growth will come from other countries, "he adds.

That's why Goldman Sachs had already kept an ace up his sleeve. As the BRICs have lost momentum, the bank targeted those countries that promised strong growth for the next decade. In 2005, the bank launched the N-11 (Next Eleven) fund.

This equity fund invests in shares of companies of different market capitalization and can offer strong growth, as it comprises several countries exposed to different economic cycles. These countries are: Bangladesh, Egypt, Indonesia, Iran, Korea, Mexico, Nigeria, Pakistan, Philippines, Turkey and Vietnam.